michigan property tax rates 2020

You can quickly estimate your Michigan State Tax and Federal Tax by selecting tax year your filing Status Gross Income and Gross Expenses This is a great way to compare salaries in Michigan and for quickly estimating your tax commitments in 2021. The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax.

The Essential Services Assessment ESA is a state specific tax on eligible personal property owned by leased to or in the possession of an eligible claimant.

. 101000 x 50000 500. 2020 Michigan Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. If the taxable value of a house is 20000 and your rate is 35 mills then your tax is 700.

The property assessment system is the basis for the collection of property taxes in Michigan. This link will provide information on ESA who must pay ESA and how to file a statement and remit payment. Rates include special assessments levied on a millage basis and levied in all of a township city or village.

Michigan has some of the highest property taxes in the nation as measured by average effective property taxes thats total taxes paid as a percentage of the homes market value. A mill is 1 per 1000 of the taxable value of the property. 1192020 homestead tax rates non-homestead tax rates ind pp tax rates comm.

The qualified disabled veterans exemption for the 2021 tax year is 400. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. On average residents of the Great Lakes State pay 145 of their home values in property taxes.

There are -662 days left until Tax Day on April 16th 2020. 2005 Millage Rates - A Complete List. However if the parcels 2019 taxable value was 100000 and its 2020 assessed value is 98000 the 2020 taxable value will be 98000 as the taxable value may not exceed the assessed value.

Operating - - - 86392 86392 172784 - - - 26392 26392 52784. Sales of electricity natural gas and home heating fuels are taxed at a 4 rate. Michigan has some of the highest property tax rates in the country.

Additional millage information can be found on our eEqualization website. For the 2020 income tax returns the individual income tax rate for Michigan taxpayers is 425. 2019 Property Tax Rates for the State of Michigan Note.

The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan. The mathematical equation below illustrates how this is figured. Rates include the 1 property tax administration fee.

For example if the citys millage rate is 10 mills property taxes on a home with a taxable value of 50000 would be 500. What is a mill. Rates for 2020 will be posted in August 2021.

The 2020 inflation rate multiplier will appear on the 2020 Notice of Assessment which owners should receive in February 2020. You Can See Data Regarding Taxes Mortgages Liens Much More. If the taxable value is 10000 and your tax rate is 35 mills then your tax is 350.

The 2018 average property tax bill in Michigan was about 2400 on an owner-occupied home according to data from the Michigan Department of Treasury. The average local income tax collected as a percentage of total income is 013. This booklet contains information for your 2021 Michigan property taxes and 2020 individual income taxes homestead property tax credits farmland and open space tax relief and the home heating credit program.

Thats based on an average tax rate of 41. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. The Local Community Stabilization Authority Act 2014 PA 86 MCL 1231341 to.

Ad Get a Vast Amount of Property Information Simply by Entering an Address. The State of Michigan published 2020 rates in Spring 2021 Contact us at. Millage rates are those levied and billed in 2019.

Counties in Michigan collect an average of 162 of a propertys assesed fair market value as property tax per year. For the 2020 Tax Year. State Equalization Online Filing.

While the Michigan income tax brackets are not modified for inflation on a yearly basis the Michigan personal exemption is. 1410 Plainfield Ave NE. Michigan is ranked number eighteen out of the fifty states in order of the average amount of property taxes collected.

Pp tax rates city of novi 2020 millage rates - final s lyonnovitransfer july december total july december total july december total july december total 00184 school. The special exemption for the 2021 tax year is 2800. Property owners can calculate their tax bill by multiplying their taxable value by the millage rate.

Report is for rates billed in 2019. Various millage rate exports are available under the Review Reports section. For the category select Excel Exports then select the desired report from the report drop-down list.

Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 193869 373869 133869 253869 193869 373869 Caledonia Twp 011020 ALCONA COMMUNITY SCH 188531 368531 128531 248531 188531 368531 Curtis Twp 011030 OSCODA AREA SCHOOLS 200781. The Great Lake States average effective property tax rate is 145 well above the national average of 107. The Certificate of Stillbirth from Michigan Department of Health and Human Services MDHHS for the 2021 tax year is 4900.

To estimate your tax return for 2021 22 please select the 2021 tax year. Follow this link for information regarding the collection of SET. The personal exemption for the 2021 tax year is 4900.

The tax rate for the 2021 tax year is 425. 2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. Use the Guest Login to access the site.

All It Takes Is A Big Unexpected Expense Or A Few Months Of Unemployment And You Re Behind On Your Mortgage Or Tax Pa Tax Payment Unexpected Expenses Mortgage

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

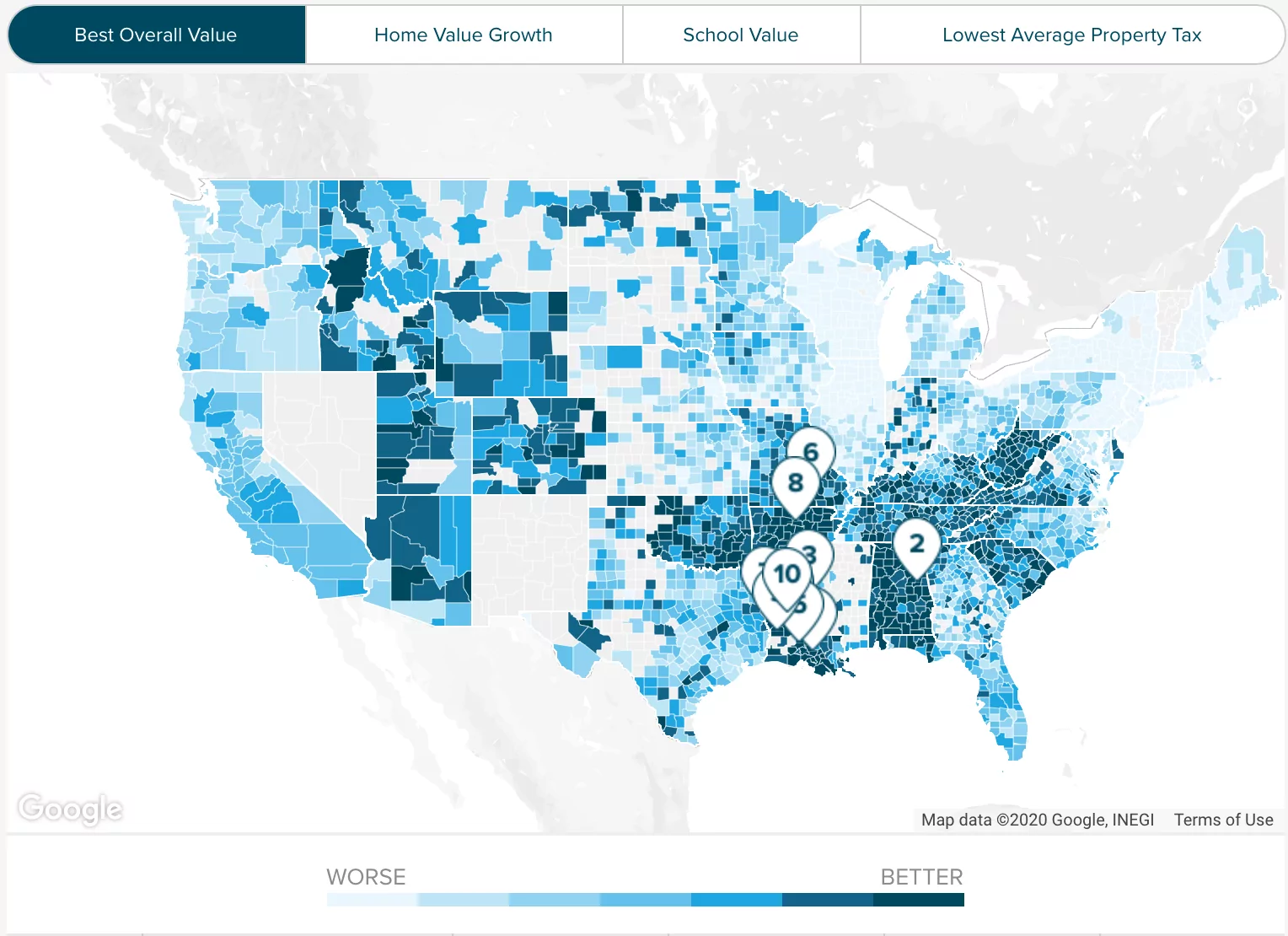

9 States With The Lowest Property Tax Rates

Anoka County Mn Property Tax Calculator Smartasset

Georgia Property Tax Calculator Smartasset

Michigan Property Tax H R Block

Diversify Detroit S Tax Structure To Lower The City S High Property Tax Rate Citizens Research Council Of Michigan

Maureen Francis On Twitter Property Tax Financial Information Public School

Detroit S High Property Tax Burden Stands As An Obstacle To Economic Growth Citizens Research Council Of Michigan